In President Obama recent state of the union address , he made the comment that “We have a supply of natural gas that can last America nearly one hundred years, and my Administration will take every possible action to safely develop this energy.” It is a statement I have heard and seen reported in a variety of areas including statements from Oil and gas groups like the API, as well as mainstream media like Bloomberg and the NYT. Presidential SOTU addresses are generally best ignored as meaningless election year promises of fixing the economy, remaking education and restoring the American Dream, whatever that is, or was. The promises and claims made by Obama and the micro-cephalic that preceded him are usually taken with less than a grain of salt by his captive audience and I daresay by the nation. Some of the claims in past SOTU's have been absurdly unrealistic like Bush's promise of a "hydrogen economy" but Obama's hundred years of supply comment was patently bogus. I was dismayed that the media just swallowed it as if it were true. In this blog I will try to examine the basis and motivation for his bogus or mistaken assertion.

First: We don't have 100 years of natural gas. I have spent more than a week looking at production and consumption data from a myriad of sources and fair warning to the reader, finding consistent data is difficult and my advice to the thoughtful reader is to believe nothing unless you can verify it independently and personally, including my data! So let's start with the basics. Oil and gas data is collected and collated from many sources and reported to various state and Federal agencies on varying time scales with inconsistent terminology. How and what these sources report appears to be a function of their bias. After sorting through piles of data,I reminded of Lily Tomlins observation"No matter how cynical I get, I find I just can't keep up."

Now to basics. Terminology. I have derived this terminology from the following organizations: USGS, EIA, API, IEA, Potential Gas Committee(Colo School of Mines) as well as the usual wiki and google searches.

You start with Resources and Reserves. It is vital to understand what these terms mean.(I would advise the reader to sketch out on a blank sheet of paper the branching tree of reserves and resources as it can be very confusing. The RESOURCE BASE is all the gas in place everywhere. It includes easy to get, hard to get, impossible to get. It is subdivided into Probable, Possible and Speculative Resources. Probable is the most important category. Current producing fields are said to have 537 Trillion cubic feet(TCF) + a trivial 13 TCF from unconventional Coal Bed Methane(CBM) giving a probable resource of 550 TCF. The US currently consumes 24 TCF/year, or 66 Billion Cu ft/day. For simplicity I will ignore speculative and possible resources but they will explain the 100 years of supply comment by Obama. Resources may or may not be economically or commercially producible. To decide that, we move to the next big category: Reserves. Reserves can be produced with current technology and funding . They are subdivided into Proved(proven), reserves and Unproved Reserves. Some organizations call these unproved Reserves or technically recoverable Reserves. Allowing these synonyms has led to confusion and obfuscation. Proved Reserves are subdivided into Developed Reserves and Undeveloped Reserves. A Developed Reserve includes drilled wells that are producing in place. The money has been spent, the wells are drilled, and no significant capital expenditure(CAPEX)is needed. Undeveloped reserves will require additional funding to put in new wells but the resource is assumed to be there as a near certain Reserve. These Proved Reserves are the highest category for acquiring funding and are also called P90 Reserves. This means there is a 90% or greater chance of successful development and extraction. Until Dec 2009, this was the only category that companies could also use as collateral for a loan. In Jan 2010, this was changed when Unproved Reserves were allowed as reportable reserves by companies to investors and the SEC . This is significant and potentially problematic. These Unproved Reserves are further subdivided into Possible Unproved Reserves and Probable Unproved Reserves. Probable unproved are given the P50 technically recoverable designation and Possible are given only a P10 probability. The reliability of these reserve numbers is unknown. Previous to 2010, companies used these reserves only for internal planning and couldn't use them as part of their publicly reported reserve base. Various third party analysts and rating groups can and do examine these reserve figures. I would offer that these are caveat emptor figures. (Recall what happened with the various independent rating agencies looking at mortgage securities.) So let's total up the various categories of Reserves and Resources and see how much gas supply the US has. If you add up both Resources and Reserves, you get a big number of 2170 TCF. Dividing that by current annual consumption I get 90 years of supply, not 100. Let's call it an Obama rounding error. Keep in mind that only 273 TCF of gas is in Proved reserves which the country can count on. This is 11 years based on 24 TCF annual consumption. If consumption goes up then the years of availability goes down.

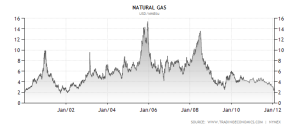

If you include Probable Resources and Proven Reserves, you are up to almost 23 years of supply . If you include all resource categories you get 90 years. This is a generous scenario assuming everything will be produced at any price from everywhere, but remember even this unlikely scenario is impossible if you are talking about $2.60 /million BTU gas. There is no way the O &G industry can survive at these prices, and at these low prices you can ignore inflated all category supply estimates. The media and most especially organizations like the NYT, Bloomberg, Fortune Magazine among others, have written articles promoting the inexhaustible abundance of fossil energy given new technology which is leading straight to a new American Energy Independence. Many of these articles are using questionable data of energy lobbying groups, confusing and inconsistent data from the Federal data set of the EIA, and out of the mouths of campaigning politicians who either are mistaken, lying or being deliberately evasive. Bill Clinton remarked that "you can't get elected by promising people less." What is coming out of the Obama administration and the corporate media is nothing less than propaganda using manipulated statistics and data. In a recent interview, the financier Warren Buffett described the housing bubble as a case of national "mass delusion." It will be my contention that the current yammering about making America "energy independent" is another example of mass delusion, promoted by politicians and corporate financial oil and gas interests. To understand how we came to this current bubble of nat gas, we need to look at fracking, or using techniques of fracking or fracturing the source rock. Gas is trapped within pores in the rock. Some rocks are permeable to oil and gas flow and some aren't. Shale rock holds lots of gas and oil in some areas and fracking opens up this rock and enhances flow rates. Fracking technology is not new. Almost 100 years ago, drillers were dropping dynamite and nitroglycerin down wells to fracture the rock. A variety of fracking has been used by various drillers since. In the 1980's a man named Mitchell devised more sophisticated and efficient horizontal drilling fracking methods using high pressure water, sand and chemicals. This elaborate techniques to get at previously hard to get tight gas/oil really took off in the past 10 years after Devon Energy bought out Mitchell and others got into the technology. With no barriers to entry other that obtaining finance, all manner of investors and oil and gas companies have started a veritable gold rush. The major gas fields in order of development and production are the Barnett in Texas, the Fayetteville in Arkansas, Haynesville in Louisana, and the Marcellus in PA, NY and W Va. Early gas flows, particularly in the Haynesville field were huge, in the range of 3-7 Billion CF/D! These early gushers were hyped to investors and the media as a new dawn. Fracking was promoted not as a new drilling method but as a manufacturing process leading to a long production life and a flat extended hyperbolic production profile. Companies flooded these neighborhoods bidding up lease prices from a few hundred dollars an acre to $30,000/acre for example in the Haynesville. For the early entrants, natural gas prices(click to enlarge)

were high and lease costs were low and production was abundant. The smart operators hedged their production forward to lock in these good prices. There were a few doubting Thomas's who noted that fracking was 3-10 times more costly than old time vertical bore technology, and it seemed to be messing up water wells in some areas, but if all the hype was correct, then vast new reserves were available and millions and billions of dollars were there for the taking. America would be free from foreign energy supplies, we could convert our car and truck fleet to gas, we could permit new gas terminals and export gas to the world, cut our trade deficit.........the American Dream was back!

Didn't happen. But the cheerleaders kept cheer leading, Wall Street kept shoveling, Investors, foreign and domestic kept flocking, and the gas kept flowing. Unfortunately, the weather kept warming, the economy kept tanking, and all of sudden in the past 6 months gas prices started dropping, and dropping and dropping! Today there is talk of $2 gas. With the forward hedging contracts expiring, the emperor is starting to be seen as lacking clothes, by a few people. We are starting to see thoughtful studies of how much gas is really there and at what price. Goldman Sachs and others including the independent geology analyst Arthur Berman have looked at the profitability of the various shale gas regions. Profitable gas price levels if you include all lease and production costs are in the range of $6 to $9 gas to break even. And surprising to me, it does appear that we are at or past production peaks in the Barnett, the Fayetteville, and many other regions. Only the Haynesville is increasing.The expensive plays like the Haynesville have break even costs in the $9 range. Even the big players like Chesapeake and Exxon are cutting back drilling and shutting in their wells . Fracking was promoted as the answer for the world's energy needs. Poland was said to have huge potential. Exxon fracked in Poland and gave up after spending $75 million but this and other dry holes have been generally under reported. And inexplicably,in a recent preliminary release, the EIA appeared to slash the size of the shale gas resource. Ominously, only recently has the extent of the negative cash flow in the fracking players come to light. According to analysis by ARC Financial Research, the 34 top U.S. publicly traded shale gas producers are currently carrying a combined $10 billion quarterly cash flow deficit. Obviously this cannot continue for long. The low gas prices are predicted to remain low, below $5 for the foreseeable future according to the EIA. True or not, this has consequences for states like my native Wyoming for government budgets and for over leveraged and highly indebted O & G companies. Eventually gas prices will have to rise. Absent a pretty rapid price recovery for natural gas, this bubble will pop. I plan to look at other aspects of shale gas and oil in future posts including investment implications.

No comments:

Post a Comment