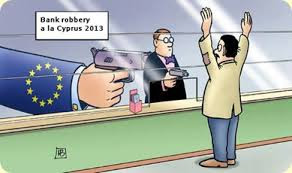

The looting of Cyprus bank deposits by EU financial authorities sent a shiver down my financial nervous system. You know the anatomy, right? There is the central nervous system(CNS), the autonomic nervous system(ANS), and the financial nervous system(FNS). I don't want to get into the complex anatomy and function of the three systems. I'm not even sure where the FNS lives but I suspect it is in the left brain somewhere. Regardless, I know a shiver when I feel one.

In case you haven't been paying attention, EU banking authorities as part of a rescue package of the insolvent Cypriot banking system, a subset of the insolvent Greek banking system, has seized a portion of depositor assets in those banks above a certain level. The level and the proportion varies from day to day but everything above a 100,000 or 200,000 Euros will be subject to a levy of a variable amount from 30 to 90 %. The banks were closed to prevent a run and capital controls instituted. Now a pensioner can just get a few hundred Euros a day to buy a herring and a bottle of Retsina, or whatever it is that Cypriots drink. It is a very confusing and malreported story and to say that this so called rescue package has been bungled is putting it mildly. We were initially told that most of the money was Russian hot money from the mob, or wealthy oligarchs hiding it from tax authorities in Moscow. They were just getting what they deserved. The true story is of course a lot more nuanced but I would like to not get into the details, however interesting. An expat oligarch losing some spare change is not what gave me the shiver. What gave me the shiver was the connection I made to a report that went viral in the New Zealand blogosphere a week or so

back as reported by Mish Shedlock in his

blog. A reader in NZ had written Mish that the

Reserve Bank of NZ had announced that depositors could be tapped to bail out the banking system. What was unique was that the NZ Central bank laid it out in clear language to the public. Here is a portion of the text:

"The OBR policy is designed to ensure that first losses are borne by the

bank’s existing shareholders. In addition,

a portion of depositors’ and

other unsecured creditors’ funds will be frozen to bear any remaining

losses." BTW, the Bank of NZ does not have so called deposit insurance.

Today Mish reported that The Bank of Canada has announced a similar policy. Here is the quote:

"The Government proposes to implement a bail-in regime for systemically

important banks. This regime will be designed to ensure that, in the

unlikely event that a systemically important bank depletes its capital,

the bank can be recapitalized and returned to viability through the very rapid conversion of certain bank liabilities into regulatory capital." Did you notice:?Bail in? That is of course bankese for BAIL OUT.!

Here is the

link to that ominous sentence, buried deep in a ponderous report. AS Mish notes, it is on pg 145.

So depositors got tapped to bail out the criminal ponzi banks in Cyprus. But it couldn't happen here. Right? Wrong. It obviously can happen in NZ and Canada. But in the US? The cradle of liberty. The home of the brave? yup. It does appear so. I found it rather easily by simple searches of my favorite financial bloggers, among them Yves Smith, Steve Keen, Tyler Durden, and particularly

Ellen Brown.

Ellen turned up a

paper from last December . This was a joint FDIC, Bank of England position paper just restating what had already been discussed

at the G20 Financial Stability Board in Basel, Switzerland. Here are a few choice sentences from that document translated by Ellen Brown:

"An efficient path for returning the sound operations of the G-SIFI to

the private sector would be provided by exchanging or converting a

sufficient amount of the unsecured debt from the original creditors of

the failed company [meaning the depositors] into equity [or stock]. In

the U.S

., the new equity would become capital in one or more newly formed operating entities. In the U.K., the same approach could be used, or

the equity could be used to recapitalize the failing financial company itself—thus, the highest layer of surviving bailed-in creditors would become the owners of the resolved firm. In either country

, the new equity holders would take on the corresponding risk of being shareholders in a financial institution."

Can't happen here , huh? What it says is that one of these TBTF banks can seize depositor assets and convert it to

BANK STOCK (!), obviously against your will. You thought you had a nice safe FDIC insured deposit in say the Bank of Amerika. Sorry buster. Now you are a happy shareholder. And bank shareholders are not under the FDIC umbrella.

Now it just gets worse. If you have deposits in one of these TBTF banks, you might be under the impression that those deposits are your money, assets to the bank, right? Not quite. In bank legalese, your money is not classified as a bank asset. It is actually a

liability. Go figure? It is u

nsecured debt, and what is particularly evil, it is not senior to a lot of other claims that the bank might have. And guess what is senior to your deposits(oops: sorry: liabilities): Derivatives exposure. These banks have moved their derivatives in effect mingling with your CD's. Here is how Yves Smith puts it:

"The 2005

bankruptcy reforms

made derivatives counterparties senior to unsecured lenders. Lehman had

only two itty bitty banking subsidiaries, and to my knowledge, was not

gathering retail deposits. But as readers may recall, Bank of America

moved most of its derivatives from its Merrill Lynch operation its

depositary in late 2011.

As Bloomberg reported:

Bank of America Corp. (BAC), hit by a credit downgrade

last month, has moved derivatives from its Merrill Lynch unit to a

subsidiary flush with insured deposits, according to people with direct

knowledge of the situation…

Bank of America’s holding company — the parent of both the retail

bank and the Merrill Lynch securities unit — held almost $75 trillion of

derivatives at the end of June, according to data compiled by the OCC.

About $53 trillion, or 71 percent, were within Bank of America NA,

according to the data, which represent the notional values of the

trades.

And Bank of America is hardly unique. Bloomberg again:

That compares with JPMorgan’s deposit-taking entity,

JPMorgan Chase Bank NA, which contained 99 percent of the New York-based

firm’s $79 trillion of notional derivatives, the OCC data show."

Whew!!! Can it really be this bad? Remember we are dealing with the Big banks and the TBTF Federal Reserve, a cartel of those banks. These banks are called TBTF banks for a reason..

I have no idea what the likelihood of such a scenario like this occurring. But if in fact savers deposits are in effect, unsecured deposits, then taking these deposits out of these banks seems prudent. And I don't just mean CDs. In the 30's Gold was confiscated by the government and the government already has authority under homeland security to seize safe deposit boxes and confiscate what is in those boxes whether it is gold, silver, guns or whatever. In a bank run or similar collapse scenario, there would not be access anyway.

The key point to get from this post is that the big banks and the big Central banks are all in the same fraternity worldwide. They are globalized just as the problems are globalized. If it happened it Cyprus, it can happen in Spain, in Italy,in the Commonwealth countries and certainly here in the US, the birthplace of Derivatives. The best financial strategy has always been to panic early.

No comments:

Post a Comment