Welcome to my world, Frackhole, Wyoming. If you're wondering what the roads out here in the West look like, have a gander at this scenic vista of oil and gas trucks as far as the eye can see. Of course there have been many days when the eye can't see very far because of these trucks and the dubious economic benefit they have provided in my little corner of heaven. You know what I am talking about if you happened to be driving through Pasadena California in say, 1956. You see here in Wyoming in the vicinity of the Pinedale anticline or in the little town of Pavillion, we have this little problem with "externalities." as the economists like to term it. Other people would call it air and water pollution, but we term it the cost of progress. Wyoming has been pulling gas out of the ground for a long time but it's only been in the last 5 years that we have had choking Pasadena smog. Unless you are a underemployed roustabout happy to finally have a job, or one of equipment suppliers or camp followers of the oil and gas industry, you might be a wee bit unhappy at water you can't drink and air you can't breathe. On the other hand, you might just decide to "cowboy up" as we say. "This isn't your first rodeo," as we also say. If you ask some of the denizens of Sublette county what they think, you might also hear something along the lines of "You can't eat mountains," if your job depends upon those long truck convoys.

In this blog, I have been covering energy and economy issues looking at cause and consequence, and at past and future trends. Out here mining and energy pay the bills while the rest of us go along for the ride, reaping the benefits, paying no income taxes and sending our kids to good schools taught by well paid and well trained teachers. We have seen boom and bust times before and it's boom now. It's my guess we are seeing perhaps our last big boom. Vast quantities of oil and gas has been exported but we could always see the mountains. On some days now we no longer can. It's no secret that our politicians have long since been captured by these resource industries. They take the money and turn their backs and when the citizens hold meetings and complain that their eyes burn and their children can't breathe, the state tells them to car pool and drink bottled water or call for more studies from non EPA analysts who aren't biased virementalists.

Now is as good a time as any to get back to why a big reason for the Pasadena air in Sublette County. I have an acquaintance who is a geologist near Pinedale who said some of his new drilling rigs are using Nat Gas instead of diesel. Where then was all that ozone coming from? Nat gas is clean, right? So I wondered about the fracking pumps and started digging. It seems they are really huge with very powerful diesel engines on the order of 3000 to 6000 hp. And here is the kicker. They don't frack with one pump. They might frack with a dozen or two linked together in an array. Here is what they look like:

Boys, it looks like we got ourselves a CONVOY!

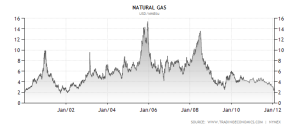

I have not emphasized the negative environmental cost of energy because until this century, it wasn't always that obvious other than a occasional drunken tanker skipper blundering into hard things or the occasional blowout or explosion. Lately these negative externalities are getting harder to avoid as we go down the backside of Hubbert's Peak going from easy oil and gas to harder frack gas and shale oil. Now we drill not in good old Texas, home of the Chevy Suburban and longhorns but in god forsaken deserts in North Africa , the Arctic and deep water Gulf of Mexico. But in the past 5 years with US crude production down under 5 million barrels a day and imports almost 15, the industry decided to go after the hard expensive oil that was left right here in the good ole US of A. Fracking is not entirely new because a screwball in 1920 threw nitroglycerin into an oil well to see if that would perk it up a bit. It did, but the idea of getting oil and gas from tight reservoirs really took off with the first commercially successful venture in the Barnett Shale in Texas in 1998. It is still a very new and somewhat secret technology, not well understood even by its promoters. Some of the early wells in the Barnett and particularly in the Haynesville Shale next door in Louisiana were producing truly astonishing daily flows with gas pressures approaching 8000 psi. It looked like a whole new game. In mid decade natural gas was $10-13, and . US production of nat gas appeared to be in terminal decline. The government even began permitting LNG import terminals in places like Sabine Pass, LA to fill a looming gas deficit. Companies like Exxon ,Chevron and Total rushed to get into the next big gold rush. With their financial backing, little known companies like Chenniere were able to line up financing of $10 Billion. Chevron and Total signed long term delivery contracts until 2029 of $125 Million a year with Chenniere. It has been a disaster for those two with only a single tanker delivery. Other companies like Chesapeake in Oklahoma City were betting on the domestic fracking technology and were snapping up leases using borrowed money every which way but loose. Wall Street bankers who knew a few things about bubble creating by then, got into the act and began throwing money at any wildcatter with a drill bit and a truck with a frack pump. The boom began as every available rig was rushed to Texas, Louisiana, Arkansas and lately Pennsylvania. Within just a few years the US went from importing 15% of its gas down to only 12%. The early players cleaned up. I even got in, buying Chesapeake at under $20 and saw it rocket to $70. It was deja vu 1920's with everyone doing the Charleston. But then with all this supply, gas started falling, and FALLING, and FALLING until it hit $2 last year. Even well capitalized companies like Exxon said "We are all losing our shirts!" Today the spiritual father of this boom Aubrey McClendon, the CEO of Chesapeake, the country's 2nd largest producer of gas, cleaned out his desk and handed in his keys to the executive washroom in downtown Oklahoma City. You can only lose money so long. It looks like Aubrey wont be the last to go. I have covered the fracking bubble for the past year and have pointed out what appeared to me to be the economic insanity of gas fracking with $2 and $3 gas, with each new well costing $10 million and $5000 leases now $30,000. Haynesville was said to be possibly the 4th largest potential gas resource after Quatar, Iran and Russia. That was the hype then. Wall Street's snake oil salesmen promised huge EURs(estimated Ultimate Return) using a long term production model as they termed it, of up to 65 years,because the flows were so great and the shale formation so big. But after a few years the producers started whispering to themselves that pressures and flows were dropping like a rock after only a few years. In two years some flows were down 80 to 90%. And some of the new wells were duds. We began hearing the term "sweet spots" where production was high. That's where you wanted to drill but knowing where the sweet spots were required drilling where it wasn't so sweet and drillers began burning money as most of the leases were structured as "use it or lose it". And if annual payments were required, cash flow even from mediocre wells was a consideration. Then in 2009 the SEC put in some new rules which allowed companies to increase their reserves as long as the companies could demonstrate decent production. It had the effect of allowing better access to credit but demanded more drilling. I think you are seeing that we are in a positive feedback loop in which the more you drill, the more you needed to drill.With all this production, prices kept falling. Almost nobody except a few independent analysts noticed. Not the media, including respected organizations like the WSJ, the NY Times, Bloomberg and even the Paris based IEA and the US EIA who chortled on about a brave new world of US energy independence. They predicted the US would be back on top as the world's biggest coal and oil producer as well as a natural gas exporter. I didn't buy it and some very bright energy analysts didn't either. I pointed out the obvious similarities to the bubbles in tech and real estate. The same Wall Street suits who brought you trash real estate derivatives were and are still involved in the Frack bubble. They are even today securitizing gas and oil leases among other products. In a sense, that is what it is about now, land, not gas. Wall Street is up to its neck hyping joint ventures, partnerships, asset sales, and stock offerings.They have lately spent a lot of time in China. Even the Hedge funds and private equity guys like the Carlysle Group and Blackstone are in there dealing. It probably wont be long before Mitt Romney smells blood and rushes in to scoop up the carcasses to slice and dice and sell off.

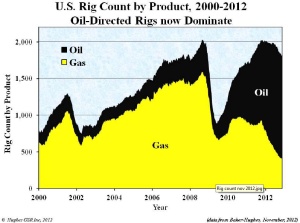

One of the indicators I follow is the Friday reporting from Baker Hughes giving the quantity and location and type of drilling rigs nationwide. I have mentioned that the fraction of rigs devoted to gas has been declining pretty steeply and here is the latest graph:

AS you can see our gas rigs peaked in 08 and have been dropping since like a stone. You can also see that the US rigs are the majority of world rigs but it should be noted that neither Russia or China, nor off shore rigs are represented. The steep decline in US gas rigs portends a decline in production at some point because most of those US rigs were frack wells with steep depletion profiles.See above. I expect production to fall off in the not too distant future, especially if gas prices remain unsustainably low. There are a lot of big players who are banking on low gas prices and increasing production as a keystone of their business models to set up petrochemical and fertilizer plants, nat gas filling stations and LNG Export terminals. There are politicians on all sides who want to see it happen despite the obvious business conflicts. I see it as very interesting and a subject of a future blog.

Notes and comments on Ecosystem Energy economics,Global Climate change, Planetary Overshoot and Coping Strategies Generating Resilience at the End of Growth living on a Wyoming Farm

Wednesday, January 30, 2013

Wednesday, January 23, 2013

Energy Investment Tip vs. Time to rethink CNG?

Links

Links This graph shows the shift from gas directed to oil directed rigs here in the US. You will note that not only are rig counts dropping for oil and gas but gas rigs are dropping faster than oil rigs.

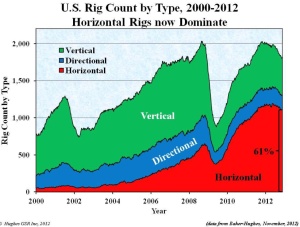

The next graph shows the type of drilling rigs and their relative proportions. Be advised that horizontal rigs predominate in the shale oil and gas fracking fields.

As you will note, rig counts have dropped over 10% in the past year. The Baker Hughes site records 2008 rigs last year in North America and 1749 now. North America has 2/3 of the world's rigs.

Also keep in mind that fracking wells both oil and gas have stupendous depletion profiles after the first year, unlike conventional vertical casing wells drilled in more porous gas fields. This means that the only way to maintain and increase production is to drill more wells year over year. This is clearly not happening. If I am right and that this marks a turn in gas prices, that will be good news for gas states like my native Wyoming who depend upon energy royalties. IT could be good news for my natgas investment portfolio. This statement in no way constitutes investment advice because I have made and lost large sums investing in energy but I took the dive under the assumption that gas would rise. I also was bottom fishing when gas was near $2.

I would also like to draw attention to this article from Bloomberg about falling daily shipping rates for the LNG tankers plying the world's oceans. There had been a slight shortage of these ships but the shipyards are pumping them out and supply and demand is getting into line. Mind you these ships are about the only positive cash flow ships out there and if I were a gas producer, I would conclude that it is now time to gear up my LNG terminal with some assurance that there will be ships to carry it. This is potentially yet another nail in the coffin to those pesky low NG prices.

I would like to give credit to Kjell Aleklett and his excellent energy website:Aleklett's Energy Mix for his excellent graphs. If you are one of those folks thinking about dropping some chump change into a CNG retrofit to your garbage truck or suburban, caveat emptor.

Friday, January 18, 2013

Natural Gas Chaos: Part 2

I recently did a guest editorial in the Jackson News and Guide, our fine local paper in which I commented upon the wisdom of promoting and subsidizing a NG filling station in Jackson. The paper also quoted me during a phone conversation in a recent follow up which was accurate, as well as from the promoter, Dennis Lamb, John Willott a retired Exxon Senior Vice President, and Keith Phucas of the Wyoming Liberty Group. In the letter I tried to present the economics of NG as a transport fuel by providing hard concrete data and I did not touch upon other important aspects of NG and energy production such as pollution from emissions and contamination of water supplies, and NG bubble economics etc. I have covered some of those aspects in this blog in the past. In this post I would like to add some detailed supporting data along with tables and graphs which were not feasible in my compressed guest editorial.. I will provide references to support my data and conclusions within this post and at the end as well. I caution the reader to be circumspect and skeptical of all presented data whether from me or any other source and to do due diligence before reaching their own conclusion. I would urge the reader to rely on independent assessments and audits which is what I try to do.

Dennis Lamb was quoted as saying "Anytime you can get an alternative fuel source that has 10% of the toxins emitted for half the price, it's a win-win." I certainly have no idea what this incoherent statement refers to. Pulling statements out of context is often unfair and discourteous, but I am puzzled nonetheless. What toxins is he referring to? Half of what price and where? The two nearest CNG stations to Jackson are in Riverton and Rock springs and the current price is $1.96 and $1.61

respectively. I am under the impression that these prices do not include fuel tax. Prices in the nearest metro areas of and Denver range from $2.33 to $2.80 and appear to be just ove $1.30/ gal in Salt Lake. The 10% toxins part of Lamb's comment if that is indeed what he said, is mystifying. Promoters of NG like to state that NG is the cleanest fuel of the big three but that is misleading. It is true that there is somewhat less CO2 emitted per BTU of NG when burned at the source.. Here is a link to a graph of emissions of the three energy fuels and their relative emissions over a 20 year period. The graph shows that shale gas emissions exceed emissions from diesel, oil, and coal. Another important fact to remember is that methane is 105 times more powerful than CO2 as a greenhouse gas. Hence the worries about the methane hydrates in Siberia which could be released by Global Warming. All fossil fuels contribute to global warming and NG is no less a culprit than coal or oil if you believe this power point presentation. I fail to see the win-win situation as promoted by Lamb. Looks like win-win if Lamb obtains free taxpayer funds and lose-lose for the rest of us. Which brings up the point of subsidies. How much subsidy did Bob Shervin receive when he built his Sinclair station just up the street from where Lamb wants to site his? I haven't talked with Shervin but if the taxpayer is going to subsidize Lamb, then I think Shervin and the other station owners deserve the same subsidy, even if it has to be given after the fact.

I would now turn to the supply side of the argument in more detail which I briefly covered in my earlier post. Willott seemed to agree with me when I said there was a 11 to 23 year supply of NG and then he added that "some would say it's more than 150 years of supply." There is no one credible who is saying any such thing. John flipped from reserves which are economically recoverable to resources which are not at current historical prices. In fairness to John, the NG resource base world wide is probably huge especially from Alaska and Canada through Siberia not to mention worldwide deep water gas resources. Nobody has surveyed Antarctica which almost certainly has a resource. But again:think Reserves not Resources! Could these enormous resources be tapped as John says? Of course they could, but they are not affordable. It's the same for coal resources. They are huge but the reserves of affordable coal are not. There of course is no concrete number of affordability of an energy resource but at least in the case of oil, when the per barrel cost gets much above $100, the world economy gets cranky. The at times deceptive statements from the energy promoters almost always ignore the concept of net energy. If a resource is so deep or so distant that it takes as much energy to mine it as the energy you get out of it, then it is for all intents and purposes a resource that will never be tapped. This is the fraud of the Green River Oil shale formation in Wyoming, Utah and Colorado. It is not even oil, but waxy kerogen locked in rock and if it were recoverable as oil it would be the largest fossil energy source in the world. But remember: Economically recoverable and net energy recoverable. It is not now economic and never has been. Remember: It takes energy to get energy. Let's return to gas.The next graph is a credible estimate of how much gas we have. It is from 2011, I believe and will soon be updated. It was prepared by the the Potential Gas Committee(PGC), a quasi independent group representing the industry. The numbers are in trillion cubic feet:

The key numbers to look at are the Proved Reserves and the Optimistic reserves. There are 11 years of proved take it to the bank gas you can count on and optimistically(whatever that means) another 11 years. this is at current consumption. I will caution the reader that these numbers jump up and down as gas moves from resource to reserve category and back, but I think it suffices for planning purposes for individuals and governments. You also see probable resources, some of which could be developed at the right price.That is a key point to remember. Very little of that category will come out of the ground at $2 or $3. I will reiterate, the US IS NOT ENERGY SUFFICIENT in NG now and hasn't been for ages, and if companies like Cheniere which is completing its liquefaction facility in Sabine Pass LA have their way, the US could be exporting $3 US gas to a world which is paying in the mid $teens. BC plans to build a similar facility at Prince Rupert for Asian export. Once this trapped gas has a chance to escape to world markets to trade like oil and coal, I'll give you 3 guesses what will happen to NG prices. If you are an oil and gas producer in trouble like Chesapeake, it can't come too soon. That's why I find it peculiar that John Willott thinks gas prices will stay low. Now lets take a detailed look at gas production in a few selected states and nationwide. I will show Wyoming's numbers along with the total US production:

Please note that this includes conventional and frac production, The bottom graph can be enlarged to tease out the various large producing states. You will note that production in all states with the exception of LA are flat to declining given the low NG prices. But I concede if gas were to recover to say $13 which it was a few years back, you would likely see these graphs turn up.

I also must again state that if gas were to stay this low as John expects, I can guarantee bankruptcies or buyouts in the gas sector. John's boss, Rex Tillerson was asked in testimony before the Council of Foreign Relations last June 27 how Exxon was coping with the low NG prices. Here is an excerpt from his testimony as reported in the Wall Street Journal:

On Wednesday Exxon Chief Executive Rex Tillerson broke from the previous company line that it wasn't being hurt by natural gas prices, admitting that the Irving, Texas-based firm is among those hurting from the price slump.

"We are all losing our shirts today." Mr. Tillerson said in a talk before the Council on Foreign Relations in New York. "We're making no money. It's all in the red."

His comments mark a departure from remarks made earlier this year on how lower natural-gas prices hadn't yet hurt the company because of its operational efficiency and low production costs.

It should be noted that Exxon/XTO is the biggest NG player and wants to get its gas into LNG ships where the real money is, ASAP . The idea that the US should keep its gas at home to keep US energy prices low and promote jobs in the domestic Fertilizer and petrochemical industries apparently hasn't crossed Rex's mind. Rex like all corporate titans cares only about Exxon's bottom line and making money for EXXON and the shareholders and if he get's his LNG export terminals, he will be making money in spades.

Now let's take a look at how these low NG prices are killing the producers. Art Berman, an independent analyst in a recent paper noted that $22 Billion/qtr is needed to maintain domestic NG supply. Cash flow of the 34 largest producers is only $12 billion a quarter which of course leaves a deficit of $10 Billion/qtr!

With losses of this magnitude there is no such thing as retained earnings and so companies like Chesapeake and others have been selling off assets and seeking joint ventures or assuming more debt to keep the party going. Berman's source was the highly respected Calgary based Energy Player, ARC Financial . Here is their graph:

I leave it to the reader to draw his own conclusions on the feasibility, affordability and future of NG as a transport fuel. It certainly can be done and is being done and if individuals and investor groups want to proceed, I say more power to them. As a libertarian, I am opposed to taxpayer subsidies for them because it benefits one group and harms others. Based upon my research, I would say that there would be no benefit to switching from oil to NG for transport here in Jackson.

As a disclaimer I have both short and long financial positions in many North American energy producers and pipelines including Exxon. I have no intention of converting my car or truck to CNG.

References:

http://www.eeb.cornell.edu/howarth/Marcellus.html

http://www.resilience.org/stories/2013-01-11/shale-gas-how-clean-is-it

http://online.wsj.com/article/SB10001424052702303561504577492501026260464.html

http://www.slate.com/articles/health_and_science/future_tense/2011/12/is_there_really_100_years_worth_of_natural_gas_beneath_the_united_states_.html

http://www.albertaoilmagazine.com/2012/02/is-the-eias-new-shale-gas-estimates-off-base/

Andreoli, D., 2011, The Bakken Boom - A Modern-Day Gold Rush. The Oil Drum: http://www.theoildrum.com/node/8697.

Berman, A.E. and L. Pittinger, 2011, U.S. Shale Gas: Less Abundance, Higher Cost. The Oil Drum: http://www.theoildrum.com/node/8212.

EIA Annual Energy Outlook 2011 Early Release Overview.

EIA Annual Energy Outlook 2011 Natural Gas Tables: http://www.eia.gov/oiaf/aeo/tablebrowser/#release=EARLY2012&subject=0-EA....

Gilbert, D. and R. Dezember, Chesapeake Energy Pulls Back Amid Natural-Gas Glut: Wall Street Journal, January 24, 2011: http://online.wsj.com/article/SB1000142405297020380650457717865173251197....

Potential Gas Committee 2010 Report: http://www.potentialgas.org/.

http://www.theoildrum.com/node/9751

http://www.theoildrum.com/node/9753

And of course my previous blogs on the same and related subjects.

Hugh Owens MD Jackson Hole 2013

Dennis Lamb was quoted as saying "Anytime you can get an alternative fuel source that has 10% of the toxins emitted for half the price, it's a win-win." I certainly have no idea what this incoherent statement refers to. Pulling statements out of context is often unfair and discourteous, but I am puzzled nonetheless. What toxins is he referring to? Half of what price and where? The two nearest CNG stations to Jackson are in Riverton and Rock springs and the current price is $1.96 and $1.61

respectively. I am under the impression that these prices do not include fuel tax. Prices in the nearest metro areas of and Denver range from $2.33 to $2.80 and appear to be just ove $1.30/ gal in Salt Lake. The 10% toxins part of Lamb's comment if that is indeed what he said, is mystifying. Promoters of NG like to state that NG is the cleanest fuel of the big three but that is misleading. It is true that there is somewhat less CO2 emitted per BTU of NG when burned at the source.. Here is a link to a graph of emissions of the three energy fuels and their relative emissions over a 20 year period. The graph shows that shale gas emissions exceed emissions from diesel, oil, and coal. Another important fact to remember is that methane is 105 times more powerful than CO2 as a greenhouse gas. Hence the worries about the methane hydrates in Siberia which could be released by Global Warming. All fossil fuels contribute to global warming and NG is no less a culprit than coal or oil if you believe this power point presentation. I fail to see the win-win situation as promoted by Lamb. Looks like win-win if Lamb obtains free taxpayer funds and lose-lose for the rest of us. Which brings up the point of subsidies. How much subsidy did Bob Shervin receive when he built his Sinclair station just up the street from where Lamb wants to site his? I haven't talked with Shervin but if the taxpayer is going to subsidize Lamb, then I think Shervin and the other station owners deserve the same subsidy, even if it has to be given after the fact.

I would now turn to the supply side of the argument in more detail which I briefly covered in my earlier post. Willott seemed to agree with me when I said there was a 11 to 23 year supply of NG and then he added that "some would say it's more than 150 years of supply." There is no one credible who is saying any such thing. John flipped from reserves which are economically recoverable to resources which are not at current historical prices. In fairness to John, the NG resource base world wide is probably huge especially from Alaska and Canada through Siberia not to mention worldwide deep water gas resources. Nobody has surveyed Antarctica which almost certainly has a resource. But again:think Reserves not Resources! Could these enormous resources be tapped as John says? Of course they could, but they are not affordable. It's the same for coal resources. They are huge but the reserves of affordable coal are not. There of course is no concrete number of affordability of an energy resource but at least in the case of oil, when the per barrel cost gets much above $100, the world economy gets cranky. The at times deceptive statements from the energy promoters almost always ignore the concept of net energy. If a resource is so deep or so distant that it takes as much energy to mine it as the energy you get out of it, then it is for all intents and purposes a resource that will never be tapped. This is the fraud of the Green River Oil shale formation in Wyoming, Utah and Colorado. It is not even oil, but waxy kerogen locked in rock and if it were recoverable as oil it would be the largest fossil energy source in the world. But remember: Economically recoverable and net energy recoverable. It is not now economic and never has been. Remember: It takes energy to get energy. Let's return to gas.The next graph is a credible estimate of how much gas we have. It is from 2011, I believe and will soon be updated. It was prepared by the the Potential Gas Committee(PGC), a quasi independent group representing the industry. The numbers are in trillion cubic feet:

The key numbers to look at are the Proved Reserves and the Optimistic reserves. There are 11 years of proved take it to the bank gas you can count on and optimistically(whatever that means) another 11 years. this is at current consumption. I will caution the reader that these numbers jump up and down as gas moves from resource to reserve category and back, but I think it suffices for planning purposes for individuals and governments. You also see probable resources, some of which could be developed at the right price.That is a key point to remember. Very little of that category will come out of the ground at $2 or $3. I will reiterate, the US IS NOT ENERGY SUFFICIENT in NG now and hasn't been for ages, and if companies like Cheniere which is completing its liquefaction facility in Sabine Pass LA have their way, the US could be exporting $3 US gas to a world which is paying in the mid $teens. BC plans to build a similar facility at Prince Rupert for Asian export. Once this trapped gas has a chance to escape to world markets to trade like oil and coal, I'll give you 3 guesses what will happen to NG prices. If you are an oil and gas producer in trouble like Chesapeake, it can't come too soon. That's why I find it peculiar that John Willott thinks gas prices will stay low. Now lets take a detailed look at gas production in a few selected states and nationwide. I will show Wyoming's numbers along with the total US production:

Please note that this includes conventional and frac production, The bottom graph can be enlarged to tease out the various large producing states. You will note that production in all states with the exception of LA are flat to declining given the low NG prices. But I concede if gas were to recover to say $13 which it was a few years back, you would likely see these graphs turn up.

I also must again state that if gas were to stay this low as John expects, I can guarantee bankruptcies or buyouts in the gas sector. John's boss, Rex Tillerson was asked in testimony before the Council of Foreign Relations last June 27 how Exxon was coping with the low NG prices. Here is an excerpt from his testimony as reported in the Wall Street Journal:

By JERRY A. DICOLO And TOM FOWLER

NEW YORK—-Even energy titan Exxon Mobil Corp. is showing signs of strain from low natural-gas prices.On Wednesday Exxon Chief Executive Rex Tillerson broke from the previous company line that it wasn't being hurt by natural gas prices, admitting that the Irving, Texas-based firm is among those hurting from the price slump.

"We are all losing our shirts today." Mr. Tillerson said in a talk before the Council on Foreign Relations in New York. "We're making no money. It's all in the red."

His comments mark a departure from remarks made earlier this year on how lower natural-gas prices hadn't yet hurt the company because of its operational efficiency and low production costs.

It should be noted that Exxon/XTO is the biggest NG player and wants to get its gas into LNG ships where the real money is, ASAP . The idea that the US should keep its gas at home to keep US energy prices low and promote jobs in the domestic Fertilizer and petrochemical industries apparently hasn't crossed Rex's mind. Rex like all corporate titans cares only about Exxon's bottom line and making money for EXXON and the shareholders and if he get's his LNG export terminals, he will be making money in spades.

Now let's take a look at how these low NG prices are killing the producers. Art Berman, an independent analyst in a recent paper noted that $22 Billion/qtr is needed to maintain domestic NG supply. Cash flow of the 34 largest producers is only $12 billion a quarter which of course leaves a deficit of $10 Billion/qtr!

With losses of this magnitude there is no such thing as retained earnings and so companies like Chesapeake and others have been selling off assets and seeking joint ventures or assuming more debt to keep the party going. Berman's source was the highly respected Calgary based Energy Player, ARC Financial . Here is their graph:

I leave it to the reader to draw his own conclusions on the feasibility, affordability and future of NG as a transport fuel. It certainly can be done and is being done and if individuals and investor groups want to proceed, I say more power to them. As a libertarian, I am opposed to taxpayer subsidies for them because it benefits one group and harms others. Based upon my research, I would say that there would be no benefit to switching from oil to NG for transport here in Jackson.

As a disclaimer I have both short and long financial positions in many North American energy producers and pipelines including Exxon. I have no intention of converting my car or truck to CNG.

References:

http://www.eeb.cornell.edu/howarth/Marcellus.html

http://www.resilience.org/stories/2013-01-11/shale-gas-how-clean-is-it

http://online.wsj.com/article/SB10001424052702303561504577492501026260464.html

http://www.slate.com/articles/health_and_science/future_tense/2011/12/is_there_really_100_years_worth_of_natural_gas_beneath_the_united_states_.html

http://www.albertaoilmagazine.com/2012/02/is-the-eias-new-shale-gas-estimates-off-base/

Andreoli, D., 2011, The Bakken Boom - A Modern-Day Gold Rush. The Oil Drum: http://www.theoildrum.com/node/8697.

Berman, A.E. and L. Pittinger, 2011, U.S. Shale Gas: Less Abundance, Higher Cost. The Oil Drum: http://www.theoildrum.com/node/8212.

EIA Annual Energy Outlook 2011 Early Release Overview.

EIA Annual Energy Outlook 2011 Natural Gas Tables: http://www.eia.gov/oiaf/aeo/tablebrowser/#release=EARLY2012&subject=0-EA....

Gilbert, D. and R. Dezember, Chesapeake Energy Pulls Back Amid Natural-Gas Glut: Wall Street Journal, January 24, 2011: http://online.wsj.com/article/SB1000142405297020380650457717865173251197....

Potential Gas Committee 2010 Report: http://www.potentialgas.org/.

http://www.theoildrum.com/node/9751

http://www.theoildrum.com/node/9753

And of course my previous blogs on the same and related subjects.

Hugh Owens MD Jackson Hole 2013

Thursday, January 17, 2013

Getting High

Yesterday I strapped on my snowshoes and decided to get high. We here in Jackson Hole have been the victim of deeply subzero inversions lately and the lower you are, the colder you are. The fastest way to warm up is to climb up, which has the additional benefit of getting into vastly clearer air. Normally my wife and I put on cross country skis but if you want to ascend steep snow covered slopes, you can't beat snowshoes. So I took the opportunity to hike with a naturalist and a botanist, Andy and Amy, over on the West side of the Tetons across from a small ski area. The air above 8000 feet was bracing and clear with hoar ice crystals glimmering and wafting like fireflies off towering firs and spruces. The sky was a stunning cobalt blue, never so blue in summer which is the season we usually hike the Tetons. Not even a whisper of wind. We remarked on how effective the snow and trees were in snuffing out all sound except the occasional chirring of a squirrel or the chick-a-dee-dee-dee of that ubiquitous tiny black capped resident of the high mountains. Andy showed us pine marten tracks in the deep snow, an aspen tree clawed by bears and a huge downed tree where a bear had denned up for the long winter. The view from the top took in the distant Snake River Plain far below. It was for me a great escape from thinking about the ravages of energy extraction , environmental destruction and exploding urban populations. I had a lot to think about on the drive home which will be the subject of a future blog.

Wednesday, January 16, 2013

Robots or Jobs

Perhaps you saw the "60 Minutes" segment last week entitled"Are Robots hurting job growth." It was an eye opener for me and it showed the sudden inroads of robots into the American economy. Most of us are aware auto manufacturing uses robots but I was unaware of the capabilities of the new robots with eyes(video cameras) and brains(Artificial Intelligence) and phenomenal hand eye coordination, so to speak. Philips Electronics recently moved its shaver assembly business from China back home to the Netherlands. A lot of Chinese jobs were lost but few Dutch ones were created. Watching the speed and dexterity of the shaver assembly robots made me realize that these new robots were not your father's Oldsmobile.Some of the robots in the new Tesla factory in California can even multitask. They are particularly adept at managing, transporting and shipping inventory in distribution centers but their capabilities extend beyond manufacturing and assembly line jobs to information gathering technology and health care. A hospital in California has a fleet of them that deliver patient supplies, meals, lab tests and even fill prescriptions! They are increasingly used in in industrial agriculture in packaging and shipping and it takes no imagination at all to conjure up jobs and even professions that can be outsourced to robots.70 % of Stock transactions are computerized HFT robotic trades, if you will. Who needs airline pilots? The planes can takeoff and land unassisted already, which are tasks much less complicated than the Google self driving car in traffic. The new Boeing 787 is entirely electric, no hydraulic pilot controls, a perfect fit for Cap'n Robot. Other examples that come to mind are Amazon, UPS?FedEx, fast food preparation, big box store stocking and receiving and in my field, performing certain types of surgery and surgery assist. I recently had prostate surgery performed by the Da Vinci Robot. It turned out fine. I'm alive to blog again. 60 Minutes asked two MIT professors whether robots killed jobs and their answer :"That's the $64000 question." They proceeded to answer it in the affirmative.

In the recent past, economists have stated that technology kills old jobs and creates new ones by increasing so called aggregate demand as a result of increasing productivity and falling prices. But this seems to have ceased with robots who are fast replacing wage slaves with robotic slaves who can work 24/7, don't complain or unionize, don't need pensions or healthcare or get injured and require disability settlements. If you're a corporate CEO who cares only about the bottom line and getting rich off slavery, what's not to like? OF course the real $64,000 question wasn't asked: What happens when all work is done by robots? There are obviously profound societal and economic implications but that's TV journalism for you. It isn't called the boob tube for nothing. The show did not go unnoticed by the Robotics industry who have filled the internet with rebuttals asserting that technology and robots create jobs.Right.Some recent political figures remind me of robots. Like that guy who ran against that other Hawaiian/Kenyan fella? If he wasn't a robot I'll eat my Vise Grips. I'm digressing..... One of the main themes I hammer repeatedly in this blog is that the reader or viewer must always remember the role of bias in any argument so absent irrefutable supporting evidence, I will regard such industry rebuttals as suspect. I also find it curious that no political figures have stepped up either supporting or decrying robots. With 9% approval, perhaps the Congress fears wholesale replacement by robots. Robotic replacement of some of the workforce has profound implications for the world and the paucity of articles and news on the subject is disturbing. I can think of dozens of questions? Do robots pay taxes? Specifically payroll (Social Security!)taxes? Income taxes, sales taxes, VAT? Like all slaves, I assume that to be a negative. Slaves also don't consume or purchase the fruits of their labor. If our workers are robots, who will buy those shavers and Teslas.? If the US is returning to manufacturing using robots, wont China and other countries be doing the same? Jobs returning to the US? Don't bet on it. Robotics is globalized and the Tesla robots for example are made in Germany.. Terry Gou, the CEO of Foxconn who is notorious for his electronics sweat shops making Apple products has announced that he has already purchased robots and plans to replace a million workers with a million robots within 3 years! He currently employs 1.2 million low wage Chinese workers. AS of 2011 I read that China already has 75000 robots and we know that Chinese engineers should have little trouble designing or pirating and manufacturing a robotic workforce under their totalitarian capitalistic system. Just tell those million peasants to return to their villages. No problem. The whole dismal dictionary of the dismal science may need rewriting and rethinking. Let's start with capital and labor. What are robots? Capital or labor? The industrial revolution was about machine tools replacing hand tools, with machines doing the work formerly done by people but until now machines had not had the potential to replace most or all of the labor force. Of course like any good slave labor force you will need overseers and guards and perhaps even mechanics to repair and maintain the robots but it would seem that even those jobs could be outsourced to robots. It would seem obvious that the displaced workers just might not take all this lying down. Income disparity is already vast and keep in mind that a slave labor force collects no wages and pays no taxes. All the money will be returned to just a few company elites and their investors and the banks. What will we non robots do if robots have all the jobs except for a few engineers who design and oversee robots? Watch NASCAR? College football? Who needs thousands of colleges preparing students for jobs when there aren't many jobs? I don't read much sci-fi but it seems the only way to imagine such a future. My guess is that we have here a recipe for revolution what with all those semi automatic weapons and 30 round clips being snapped up at Wallmart. It would seem a good time to look at the Luddite Revolution 2 centuries back in an upcoming blog.

In the recent past, economists have stated that technology kills old jobs and creates new ones by increasing so called aggregate demand as a result of increasing productivity and falling prices. But this seems to have ceased with robots who are fast replacing wage slaves with robotic slaves who can work 24/7, don't complain or unionize, don't need pensions or healthcare or get injured and require disability settlements. If you're a corporate CEO who cares only about the bottom line and getting rich off slavery, what's not to like? OF course the real $64,000 question wasn't asked: What happens when all work is done by robots? There are obviously profound societal and economic implications but that's TV journalism for you. It isn't called the boob tube for nothing. The show did not go unnoticed by the Robotics industry who have filled the internet with rebuttals asserting that technology and robots create jobs.Right.Some recent political figures remind me of robots. Like that guy who ran against that other Hawaiian/Kenyan fella? If he wasn't a robot I'll eat my Vise Grips. I'm digressing..... One of the main themes I hammer repeatedly in this blog is that the reader or viewer must always remember the role of bias in any argument so absent irrefutable supporting evidence, I will regard such industry rebuttals as suspect. I also find it curious that no political figures have stepped up either supporting or decrying robots. With 9% approval, perhaps the Congress fears wholesale replacement by robots. Robotic replacement of some of the workforce has profound implications for the world and the paucity of articles and news on the subject is disturbing. I can think of dozens of questions? Do robots pay taxes? Specifically payroll (Social Security!)taxes? Income taxes, sales taxes, VAT? Like all slaves, I assume that to be a negative. Slaves also don't consume or purchase the fruits of their labor. If our workers are robots, who will buy those shavers and Teslas.? If the US is returning to manufacturing using robots, wont China and other countries be doing the same? Jobs returning to the US? Don't bet on it. Robotics is globalized and the Tesla robots for example are made in Germany.. Terry Gou, the CEO of Foxconn who is notorious for his electronics sweat shops making Apple products has announced that he has already purchased robots and plans to replace a million workers with a million robots within 3 years! He currently employs 1.2 million low wage Chinese workers. AS of 2011 I read that China already has 75000 robots and we know that Chinese engineers should have little trouble designing or pirating and manufacturing a robotic workforce under their totalitarian capitalistic system. Just tell those million peasants to return to their villages. No problem. The whole dismal dictionary of the dismal science may need rewriting and rethinking. Let's start with capital and labor. What are robots? Capital or labor? The industrial revolution was about machine tools replacing hand tools, with machines doing the work formerly done by people but until now machines had not had the potential to replace most or all of the labor force. Of course like any good slave labor force you will need overseers and guards and perhaps even mechanics to repair and maintain the robots but it would seem that even those jobs could be outsourced to robots. It would seem obvious that the displaced workers just might not take all this lying down. Income disparity is already vast and keep in mind that a slave labor force collects no wages and pays no taxes. All the money will be returned to just a few company elites and their investors and the banks. What will we non robots do if robots have all the jobs except for a few engineers who design and oversee robots? Watch NASCAR? College football? Who needs thousands of colleges preparing students for jobs when there aren't many jobs? I don't read much sci-fi but it seems the only way to imagine such a future. My guess is that we have here a recipe for revolution what with all those semi automatic weapons and 30 round clips being snapped up at Wallmart. It would seem a good time to look at the Luddite Revolution 2 centuries back in an upcoming blog.

Thursday, January 10, 2013

Natural Gas Chaos

Here is a copy of a letter I sent to our local paper in which I commented upon a proposal to open natural gas filling stations in Jackson:

Natural Gas for Transportation in Jackson?

Energy independence for the US is a hoax. Whoa Pard. Aren’t you coming on a little strong? Even the President has told the country we have 100 years of natural gas supply from its reserves? With numbers like that shouldn’t Jackson be converting its vehicle fleet to NG? Were it true, a case could possibly be made to do so. But it is not true. To start with, the US is nowhere near energy independent in Oil or Natural Gas(NG) even now with the glut of the past 3 years. The US as of last year still had to import 12.7% of its NG. For the previous 20 years, that average was 15.7%. Doesn’t sound like energy independence to me. It is essential that as citizens we understand the terminology of energy. Obama was confusing reserves with resources. To be a reserve, the energy must be commercially producible. A Resource may have production potential at some price, if it’s there. A resource is subdivided into 3 categories of probable, possible, and speculative. The US does not have 100 years of reserve NG. It has somewhere between 11 and 23 years of reserves at current consumption. It may have 90 to 100 years of NG resources, but Resources are emphatically not Reserves. Remember to be a reserve it must be commercially producible. US production of NG peaked in about 2009 and has been flat ever since. Most of the traditional gas fields in the US with the exception of Louisiana and the insignificant Marcellus Field in PA are in decline, and that includes Wyoming which accounts for only 8 % of US production. US rig counts as reported by Baker Hughes are in decline as well. There are several reasons for this chiefly the very low price for NG for the past few years hovering between $2 and $4 which for most fields is way below break even. Goldman Sachs a few years back made a presentation trying to lay out the profitability of rapidly depleting Frac Gas fields and concluded that depending on the field, a minimum price of $6 to $8 was the level of profitability. A major reason why frac gas is still being produced is because the companies have shifted their rigs to the fields having both tight oil and tight gas. The oil is still profitable and the gas is merely a by product of oil exploration and drilling. In a few places like SLC, a driver can buy gas for the equivalent of $1.25/gallon but if gas prices return to a profitable level that price will likely be at parity with gasoline. Do the math and see if that $5 or $10,000 conversion cost makes economic sense to you or to your commercial fleet. If you get say 20 mpg and drive 12000 miles a year, you will use 600 gallons/yr. At current gas prices in Jackson just below $3/gal, you spend $1800/yr. If you pay $1.50 for tax free NG, that would be $900/yr. Looks like payback is around 10 years if the price differential between gas and gasoline stayed the same which if you believe my numbers will be highly unlikely. Once gas prices return to a level of profitability, that differential will disappear. A nationwide conversion to NG for transportation is unaffordable for a country running $1 trillion plus deficits. The gas industry is begging for yet more subsidies from the Federal and state government including agencies like the Wyoming Business Council. If the City of Jackson makes the mistake of converting its vehicle fleet to NG and when prices hit parity, it will be the citizens who are stuck with the bill. If a group wants to purchase equipment and a station, by all means let them, with their own money at their own risk, and not the taxpayers of Jackson or Wyoming.

Partial list of sources for this essay: http://www.eia.gov/oil_gas/

http://www.theoildrum.com/

http://www.slate.com/articles/

Regards, Hugh Owens MD

The thoughtful reader of whether we can or should make a jump to an alternative form of energy use for transportation needs to know far more than the price differential between gasoline and CNG prices in Salt Lake City. The single most confusing issue is how production and consumption and prices are reported in the media on all the fossil fuels much like the economic and job data that is dispensed from the government. I have spent a lot and I mean a LOT of time sorting through often conflicting numbers and the data is often if not usually in conflict. So get used to it. There will be bias reported depending upon who is reporting. For example an investor group or an investment bank may report statistics tacitly designed to encourage and reassure investors pointing out a bright investment future for their particular product. You will find differing numbers reported on production and consumption even between the international agency, the IEA and the US agency, the EIA. If you go to these agency websites you may wear out your computer mouse trying to tease out what you are looking for. If you go to industry sites like the API(American Petroleum Institute), you are likely to be served up optimistic and rosy data which I generally regard as suspect unless I can find verification from other sources. For example if you are worried about the negative side of fracking for oil and gas,you might as well forget the corporations and their lobbying arms. If you read their company releases you will read that frac wells hardly ever leak or contaminate water supplies and that fracking is the new energy nirvana for the United States leading to more jobs and companies returning to the US because of low energy prices. You will see the usual cliche buzzwords like sustainable and common sense approach. When I see terms like these I know that they really translate to unsustainable and idiotic. For example, you will rarely see any mention of the negative aspects of fracking for gas or oil and its possible contribution to global warming. Methane is many orders of magnitude worse than CO2 in its contribution to global warming and I rarely see articles dealing with whether gas wells leak methane to the atmosphere. Of course they do! Anyone who lives in my state anywhere near the Pinedale anticline gas fields knows they leak. I have driven there in quiet winter days when my eyes burned so bad I could hardly see the road. I once stopped for gasoline in Pinedale and complained to the station about the smell and the smog and the cashier smiled and said"Ah...the smell of money!". The thick ozone cloud in the area has many causes besides leaking frac wells. Diesel pumps power the rigs and the frac injection pumps and my Toyota pickup is also a small part of the problem. The tragic fact is that no one knows how many wells leak and how much and you can be sure that the industry will under report it. There are a few good reports on the problem like this long monograph from Schlumberger about 10 years ago. What alarms me is that I haven't been able to find a credible source of how much the new fracking techniques of horizontal drilling involving numerous long laterals arcing out from a single pad because the old studies largely involved cemented vertical casings. Fracking doesn't involve intact cemented casings in the entire drill path. It fractures the rock far distant from the main drill bore. There is no easy way even for the drillers to know how much or how often methane finds its way up existing rock cracks or into adjacent aquifers. In the largely unregulated get rich quick wild west environment of the big frac basins, the big players know better than to open their mouths. In the state of Wyoming our captured regulators have been loathe to say anything negative about the oil and gas industry. When the citizens complain about burning eyes and getting asthma because of the gas smog, the state doesn't restrict drilling or issue cease and desist orders to the drillers. Instead they recommend that all parties should cooperate and car pool and drive less.

The second main point I would like to point out to individuals or governments contemplating a shift to alternatives to oil like CNG cars and trucks is to be aware of the unregulated and uncertain supply picture for natural gas. There is also no national regulatory body controlling gas production like there was for oil back when the Texas Railroad Commission was calling the shots for oil production in order to ensure stable prices and lower the risks for destructive booms and busts. I have looked long and hard and have been unable to find out how much gas is available and produced purely as gas plays. USGS does break down gas by type and origin. The current rig count reported by Baker Hughes shows that about 2/3 of current wells are oil and 1/3 gas but even that is a bit misleading. All manner of hydrocarbons come out of these wells. There is oil in gas wells and gas in oil wells. Gas prices are so low that the oil and gas industry is still flaring gas to the atmosphere. This is rarely reported but the industry continues this abominable practice. Some of the oil drillers do try to recover this gas and re inject it to help the oil rise to the surface but injection pumps cost money as do laying gas pipelines. Methane is being flared in the Bakken and the Eagle Ford tight oil fields today as recently reported in the Oil Drum.I have read that more than 30% of gas is as a by product of oil fracking. I mentioned in my letter that gas prices are below the cost of production. If that is the case why would the drillers not just cap the wells and wait for better prices? I wondered the same thing and found that even with the low prices,the producers have to maintain cash flow even if they are losing money because cash flow services their loans, keeps investors happy and people employed. Some of the early gas fields are of course actually still making money because they were first to the game and collared low price leases and with the high gas prices 5-6 years ago were able to hedge their production. But one must keep in mind that these producers can only lose money so long. They are hanging in as long as they can hoping for a rebound. There are many events that could trigger that rebound. If the current recession deepens and oil demand and oil price drops as some predict, oil fracking could drop below profitability. The recent cancellation of the Bakken Express pipeline could have occurred for many reasons but ultimate frac oil profitability and amortization of its cost must certainly be factors. Crude oil trades freely on the world market and is generally easily transported but North American gas is largely trapped. This is the main reason that the gas producers are lobbying hard for export LNG terminals and pipelines to let this trapped gas escape to the coasts so it can be loaded on to LNG Ships destined for Asia and European markets where the current price is many multiples above the US price. Just yesterday Transcanada obtained permission to run a 6 $Billion pipeline to Prince Rupert BC to supply Asian markets. If you wonder why a country like the US which is not energy independent in natural gas should be exporting

gas, you are to be forgiven. That's why you see so many conflicting and obfuscatory media reporting like" Fertilizer and petrochemical companies are considering returning to the US to take advantage of low price natural gas," or T Boone Pickens begging for government subsidies to convert the US car and truck fleet to CNG. The companies know that the surest way to high price natural gas is to let it escape to the world market where it will trade closer to the BTU content of crude oil. If it were, gas would be priced over $15 and that is the kind of price that would put a smile on the face of Aubrey McClendon, the CEO of Chesapeake, one of the country's big players. It is also the kind of price that would kill CNG cars and trucks, so something has to give. You can't have both.

If the reader is wondering where I come down on the side of NG vs gas for transportation, I would say NEITHER! I would like to see the country moving away from car and truck transportation of people and cargo and moving to a "fuel" that is sustainable and vastly cheaper: Electricity!,which can be generated from darn near anything, including Wyoming gas and coal. The level of public and private debt in this country is such that there is no way that a new gas pipeline/filling station infrastructure could be constructed from scratch when the country is too broke now to repair its roads and bridges. The uncertainty about price and availability of Natural gas in my opinion absolutely militates against a switch from gasoline to gas by anyone but most especially by my local government or utility if they are going to fund it from my taxes and utility bills.

If the reader is interested, I have covered this subject in more depth in previous posts last year.

Natural Gas for Transportation in Jackson?

Energy independence for the US is a hoax. Whoa Pard. Aren’t you coming on a little strong? Even the President has told the country we have 100 years of natural gas supply from its reserves? With numbers like that shouldn’t Jackson be converting its vehicle fleet to NG? Were it true, a case could possibly be made to do so. But it is not true. To start with, the US is nowhere near energy independent in Oil or Natural Gas(NG) even now with the glut of the past 3 years. The US as of last year still had to import 12.7% of its NG. For the previous 20 years, that average was 15.7%. Doesn’t sound like energy independence to me. It is essential that as citizens we understand the terminology of energy. Obama was confusing reserves with resources. To be a reserve, the energy must be commercially producible. A Resource may have production potential at some price, if it’s there. A resource is subdivided into 3 categories of probable, possible, and speculative. The US does not have 100 years of reserve NG. It has somewhere between 11 and 23 years of reserves at current consumption. It may have 90 to 100 years of NG resources, but Resources are emphatically not Reserves. Remember to be a reserve it must be commercially producible. US production of NG peaked in about 2009 and has been flat ever since. Most of the traditional gas fields in the US with the exception of Louisiana and the insignificant Marcellus Field in PA are in decline, and that includes Wyoming which accounts for only 8 % of US production. US rig counts as reported by Baker Hughes are in decline as well. There are several reasons for this chiefly the very low price for NG for the past few years hovering between $2 and $4 which for most fields is way below break even. Goldman Sachs a few years back made a presentation trying to lay out the profitability of rapidly depleting Frac Gas fields and concluded that depending on the field, a minimum price of $6 to $8 was the level of profitability. A major reason why frac gas is still being produced is because the companies have shifted their rigs to the fields having both tight oil and tight gas. The oil is still profitable and the gas is merely a by product of oil exploration and drilling. In a few places like SLC, a driver can buy gas for the equivalent of $1.25/gallon but if gas prices return to a profitable level that price will likely be at parity with gasoline. Do the math and see if that $5 or $10,000 conversion cost makes economic sense to you or to your commercial fleet. If you get say 20 mpg and drive 12000 miles a year, you will use 600 gallons/yr. At current gas prices in Jackson just below $3/gal, you spend $1800/yr. If you pay $1.50 for tax free NG, that would be $900/yr. Looks like payback is around 10 years if the price differential between gas and gasoline stayed the same which if you believe my numbers will be highly unlikely. Once gas prices return to a level of profitability, that differential will disappear. A nationwide conversion to NG for transportation is unaffordable for a country running $1 trillion plus deficits. The gas industry is begging for yet more subsidies from the Federal and state government including agencies like the Wyoming Business Council. If the City of Jackson makes the mistake of converting its vehicle fleet to NG and when prices hit parity, it will be the citizens who are stuck with the bill. If a group wants to purchase equipment and a station, by all means let them, with their own money at their own risk, and not the taxpayers of Jackson or Wyoming.

Partial list of sources for this essay: http://www.eia.gov/oil_gas/

http://www.theoildrum.com/

http://www.slate.com/articles/

Regards, Hugh Owens MD

The thoughtful reader of whether we can or should make a jump to an alternative form of energy use for transportation needs to know far more than the price differential between gasoline and CNG prices in Salt Lake City. The single most confusing issue is how production and consumption and prices are reported in the media on all the fossil fuels much like the economic and job data that is dispensed from the government. I have spent a lot and I mean a LOT of time sorting through often conflicting numbers and the data is often if not usually in conflict. So get used to it. There will be bias reported depending upon who is reporting. For example an investor group or an investment bank may report statistics tacitly designed to encourage and reassure investors pointing out a bright investment future for their particular product. You will find differing numbers reported on production and consumption even between the international agency, the IEA and the US agency, the EIA. If you go to these agency websites you may wear out your computer mouse trying to tease out what you are looking for. If you go to industry sites like the API(American Petroleum Institute), you are likely to be served up optimistic and rosy data which I generally regard as suspect unless I can find verification from other sources. For example if you are worried about the negative side of fracking for oil and gas,you might as well forget the corporations and their lobbying arms. If you read their company releases you will read that frac wells hardly ever leak or contaminate water supplies and that fracking is the new energy nirvana for the United States leading to more jobs and companies returning to the US because of low energy prices. You will see the usual cliche buzzwords like sustainable and common sense approach. When I see terms like these I know that they really translate to unsustainable and idiotic. For example, you will rarely see any mention of the negative aspects of fracking for gas or oil and its possible contribution to global warming. Methane is many orders of magnitude worse than CO2 in its contribution to global warming and I rarely see articles dealing with whether gas wells leak methane to the atmosphere. Of course they do! Anyone who lives in my state anywhere near the Pinedale anticline gas fields knows they leak. I have driven there in quiet winter days when my eyes burned so bad I could hardly see the road. I once stopped for gasoline in Pinedale and complained to the station about the smell and the smog and the cashier smiled and said"Ah...the smell of money!". The thick ozone cloud in the area has many causes besides leaking frac wells. Diesel pumps power the rigs and the frac injection pumps and my Toyota pickup is also a small part of the problem. The tragic fact is that no one knows how many wells leak and how much and you can be sure that the industry will under report it. There are a few good reports on the problem like this long monograph from Schlumberger about 10 years ago. What alarms me is that I haven't been able to find a credible source of how much the new fracking techniques of horizontal drilling involving numerous long laterals arcing out from a single pad because the old studies largely involved cemented vertical casings. Fracking doesn't involve intact cemented casings in the entire drill path. It fractures the rock far distant from the main drill bore. There is no easy way even for the drillers to know how much or how often methane finds its way up existing rock cracks or into adjacent aquifers. In the largely unregulated get rich quick wild west environment of the big frac basins, the big players know better than to open their mouths. In the state of Wyoming our captured regulators have been loathe to say anything negative about the oil and gas industry. When the citizens complain about burning eyes and getting asthma because of the gas smog, the state doesn't restrict drilling or issue cease and desist orders to the drillers. Instead they recommend that all parties should cooperate and car pool and drive less.

The second main point I would like to point out to individuals or governments contemplating a shift to alternatives to oil like CNG cars and trucks is to be aware of the unregulated and uncertain supply picture for natural gas. There is also no national regulatory body controlling gas production like there was for oil back when the Texas Railroad Commission was calling the shots for oil production in order to ensure stable prices and lower the risks for destructive booms and busts. I have looked long and hard and have been unable to find out how much gas is available and produced purely as gas plays. USGS does break down gas by type and origin. The current rig count reported by Baker Hughes shows that about 2/3 of current wells are oil and 1/3 gas but even that is a bit misleading. All manner of hydrocarbons come out of these wells. There is oil in gas wells and gas in oil wells. Gas prices are so low that the oil and gas industry is still flaring gas to the atmosphere. This is rarely reported but the industry continues this abominable practice. Some of the oil drillers do try to recover this gas and re inject it to help the oil rise to the surface but injection pumps cost money as do laying gas pipelines. Methane is being flared in the Bakken and the Eagle Ford tight oil fields today as recently reported in the Oil Drum.I have read that more than 30% of gas is as a by product of oil fracking. I mentioned in my letter that gas prices are below the cost of production. If that is the case why would the drillers not just cap the wells and wait for better prices? I wondered the same thing and found that even with the low prices,the producers have to maintain cash flow even if they are losing money because cash flow services their loans, keeps investors happy and people employed. Some of the early gas fields are of course actually still making money because they were first to the game and collared low price leases and with the high gas prices 5-6 years ago were able to hedge their production. But one must keep in mind that these producers can only lose money so long. They are hanging in as long as they can hoping for a rebound. There are many events that could trigger that rebound. If the current recession deepens and oil demand and oil price drops as some predict, oil fracking could drop below profitability. The recent cancellation of the Bakken Express pipeline could have occurred for many reasons but ultimate frac oil profitability and amortization of its cost must certainly be factors. Crude oil trades freely on the world market and is generally easily transported but North American gas is largely trapped. This is the main reason that the gas producers are lobbying hard for export LNG terminals and pipelines to let this trapped gas escape to the coasts so it can be loaded on to LNG Ships destined for Asia and European markets where the current price is many multiples above the US price. Just yesterday Transcanada obtained permission to run a 6 $Billion pipeline to Prince Rupert BC to supply Asian markets. If you wonder why a country like the US which is not energy independent in natural gas should be exporting

gas, you are to be forgiven. That's why you see so many conflicting and obfuscatory media reporting like" Fertilizer and petrochemical companies are considering returning to the US to take advantage of low price natural gas," or T Boone Pickens begging for government subsidies to convert the US car and truck fleet to CNG. The companies know that the surest way to high price natural gas is to let it escape to the world market where it will trade closer to the BTU content of crude oil. If it were, gas would be priced over $15 and that is the kind of price that would put a smile on the face of Aubrey McClendon, the CEO of Chesapeake, one of the country's big players. It is also the kind of price that would kill CNG cars and trucks, so something has to give. You can't have both.

If the reader is wondering where I come down on the side of NG vs gas for transportation, I would say NEITHER! I would like to see the country moving away from car and truck transportation of people and cargo and moving to a "fuel" that is sustainable and vastly cheaper: Electricity!,which can be generated from darn near anything, including Wyoming gas and coal. The level of public and private debt in this country is such that there is no way that a new gas pipeline/filling station infrastructure could be constructed from scratch when the country is too broke now to repair its roads and bridges. The uncertainty about price and availability of Natural gas in my opinion absolutely militates against a switch from gasoline to gas by anyone but most especially by my local government or utility if they are going to fund it from my taxes and utility bills.

If the reader is interested, I have covered this subject in more depth in previous posts last year.

Tuesday, January 8, 2013

The Wealth of Nations, revisited

I have not been riding on my trusty horse Blog for reasons obvious to anyone who

lives here in this beautiful valley in NW Wyoming. There are a lot more

enjoyable ways to spend what little time we have than sitting in front of a

computer screen. The long string of subzero days and nights has unfortunately driven

me back to my mancave and I have been mulling over a fundamental concept. What

is wealth? From what does it derive? Is wealth money? Is money wealth?

This little

digression started with a comment by my son some time ago when he noted a

pundit commenting that so many $Trillions had “vanished” in the latest

downturn. This puzzled him, so he asked me “Where did those $Trillions go?” It

was an intelligent question and I tried to explain the disappearance as part of

a general “deleveraging” of wealth assets going on over the world. Money isn’t”

wealth”, I told him. Money is a symbolic representation of wealth. I knew I

wasn’t getting through to him when he insisted that if it was money, it had to go somewhere! His perception was

that money and wealth were equivalent, which would be true if our money was a

denarius or a Morgan silver dollar, or a $20 gold piece. Unless money was in a

cask on a Spanish Galleon going down in a hurricane off Hispaniola ending up

with the scallops, when one person lost money, another probably received it, a

zero sum transaction, voluntary or not.

This

conversation became a loop in my head leaping down axons to dendrites as I

mulled over the concept of wealth from a myriad of standpoints. It’s impossible

to escape money, the economy, and economic statistics on the state of the

economy flooding us non-stop from a media obsessed with economic news.

I fled as a

participant in the Sickcare industry some years back and I have been spending a

good part of my time catching up with my education that was interrupted by too

many years learning the medical trade. I

particularly wanted to study the dynamics of civilizations, their rise and fall,

and how our civilization has changed our world and how our changing world has

altered our societies. I began at the beginning with the Big Bang and ambled

cosmologically taking side trips into physics, astronomy, and geology, hop

scotching forward and backward and into

side alleys that looked interesting. As I examined the whole span of human

history, what stood out to me was the period after about 1750, which happened

to be the the nascent industrial revolution as the premier innovation of the past 350 years.

Within this revolution have been other important innovations starting positive

feedback loops helping to sustain and accelerate the changes which began the

Industrial Revolution.

But what has this got to do with wealth and money?? Coinage

had been in existence long before 1750 to facilitate trade and commerce and

economic growth. Why is there so much more wealth in the world now than in 1750

and will wealth continue to grow

exponentially in the same way going

forward?

There were

prominent thinkers at the time taking note of the changes, among them Adam

Smith who published “The Wealth of Nations”, widely regarded at the bible of

modern classical economics. Smith was by no means the first to think about

economics. There are a scattering of economic writings as far back as Aristotle

but Smith’s achievement was in laying out terms like capital and labor and

land and how they intersect to influence an economy. It is no coincidence that

the term capitalism came into being as the system that most adapted to the

industrial revolution in the West. Capitalism of course existed well before

1750 to facilitate trade and grow a nation’s wealth and influence and in it’s ancestral form was termed Mercantilism

which followed the feudalism period of the middle ages. But let’s get back to

wealth. There certainly was a lot of wealth before 1750. Wealthy civilizations existed

in the Mesopotamian and Harappan and Aztec and Mayan Civilizations. The Romans, the first big

Empire possessed enormous wealth. How did they accrue it? In the case of the

Romans, they largely took it from their neighbors. . There was wealth, then as

now, concentrated into few hands. Keep in mind that by the time Christ was

born, there were probably only 300 million people in the world. By 1750 it had about

doubled. By 1900 the number had more than doubled to 1.6 billion and the

doubling time up to the present has been getting shorter and shorter. Why did

it take so long to double the first time, 1700+ years, and why has the doubling

interval grown ever shorter? Could the industrial revolution have had something

to do with the exponential population boom? Up until the industrial revolution

population growth was largely linear but after the industrial revolution the

curve leapt up resembling a hockey stick, the classic yardstick of exponential

growth. About 1750 a lot of things beside population also started growing

exponentially, in this case Industrial Capital, industrial machines, energy production,food

production, and, wealth production. An

intelligent observer should always be wary of the classic trap that association

is not necessarily causation. I found early on in my quest that I had to

ruthlessly simplify, in much the same way that Occam’s Razor is used as a

technique of understanding a complex system. The Razor states that all things

being equal, the simplest explanation is often the best. This notion did not

start with Occam and in fact goes far back to Aristotle and Ptolemy. So I put

the origin of wealth creation into the simplest form: You need a resource. You

need people to harvest that resource and accumulate that resource. If the

harvest involves picking up or digging the resource, all able bodied people are

equal and the harder you work, the more resource you accumulate. It takes

energy to harvest a resource, in this case human energy. The next logical step

was to find ways to speed up the harvest. Get more people into the act but don’t

let them keep the resource. Time to invent Slavery. Animals were used as well because they

possessed a lot more energy than people. Thus we now have energy from labor

combined with a resource. Let’s say that this resource is copper and perhaps

other easily accessible metals. Early on, people discovered some nifty uses for

soft malleable copper. It made a nice plate, and decent tools. Someone discovered

that if you combined a soft metal like copper with another like tin or zinc,

and melted them together, you could get a much harder and stronger tool by

taking the energy of fire, the energy of a tool maker and producing something with value added above the value of the resource

itself. Thus was born the Bronze Age.