http://www.guardian.co.uk/world/2008/oct/05/iceland.creditcrunch

Bill Fleckenstein who posts at MSNMoney and Jim Grant who has a financial consulting firm were the first sources for the following figures and Matt Blackman at the seekingalpha site has recently put them in very readable form. If you are not sitting down, by all means, sit down. No, LAY DOWN.

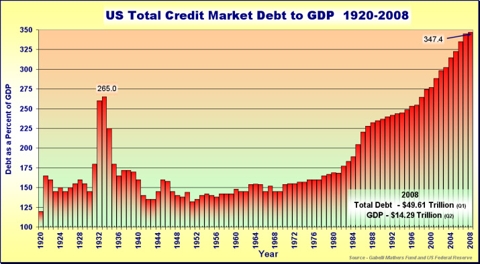

We seem to be entering a deflationary recession/depression.A variety of authors, Nouriel Roubini among them have stated that in a deflationary bear barket there are no safe havens. Almost everything will lose value(Website: rgemonitor.com). The US equity markets as of last Friday had lost a quick trillion. The Case-Shiller index reports 3 trillion in housing losses to date. The numbers that stun are the debt to GDP figures.

click to enlarge

Since 2000 all debt from homeowners, companies and government has grown 25% faster than the economy. And what kind of economy have we had in the past 8 or 10 years? Investment banking generating financial weapons of mass destruction, the last gasp of our suburban housing sprawl and mindless consumption of cheap Chinese products often funded by home equity loans. And a large part of this debt has been explosively augmented by leveraging at all levels of the investment banking, insurance, hedge fund and pension fund markets in an unregulated but highly linked greedy free for all capitalistic market which is imploding on a collossal scale. Debt as a percentage of GDP has doubled since Reagan took office and IMO when historians write the story, this depression will have said to have begun with the Reagan administration. In the first quarter of this year the total credit to GDP ratio had soared to 350%. That's right:Our credit was 3 1/2 times our GDP. In 1932 that ratio was about 2 and 1/2 times GDP. Despite what CNBC and other bobbleheads say, Treasury was struggling to peddle enough TBills and other securities to fund a deficit of "just"$400 Billion. With the bailout, that struggling could turn to flailing. Scroll down about halfway to see the pertinent graph .

The government leaders have demonstrated their cluelessness with rushed decisions poorly deliberated at odds with the wishes of their main street constuents. Will the bailout work? Probably not. The problem seems too big. Perhaps we are in the same predicament as was Henry Kissinger during the Balkan crisis when he said "Whatever we do will be wrong, including doing nothing."

There is little doubt that we are nowhere near the end of this story. What can we do as individuals?

Raise cash if you can. Sell anything that is not essential to survival. Buy nothing BUT essentials. Buy tools.Cut expenses to the bone and reduce all forms of energy consumption. Turn the heat down, buy a clothesline, carpool,combine car trips, use a bicycle, buy bulk foods and stockpile a year of staples like the Mormons. Stockpile other obious essentials like medication , batteries, warm clothing and comfortable footwear etc. In some parts of this country you may need ammunition and firearms if for no other reason than acquiring venison. Consider the possibility of losing your job, your house, your health insurance. It may not happen but try to formulate plans dealing with a calamity of this scale. You may need to move in with friends or family to save costs and combine resources. Be nice and don't burn any bridges. If you have a house, petition your local officials to slash your property taxes but be aware that if tax revenue plummets, so will services from police and fire to trash collection and road repair. Make sure you have a rleliable vehicle capable of a long road trip. Store fuel with fuel stabilizer added but be careful of the obvious danger. Discuss the situation with the family in a calm and controlled fashion.The government, the congress, and the financial markets are out of control. It doesn't mean you have to be. Your family, your neighborhood and your community may need leaders. Think about what it takes to be a good leader and try to become one.Have money and perhaps some gold or silver coins on hand and be prepared to barter.

It's not the end of the world and if it becomes a full scale depression, it will take perhaps a long time to play out. This country and many parts of the world were on an unsustainable path of heedless consumption and impossible expansion driven my unbelievable cheap energy. That party is over and we will need to think about how to remake our country and our communities into something sustainable and liveable. We will need to rebuild domestic manufacturing,build regional food production and distribution and learn to take care of ourselves on a local and regional level. We were a nation of specialists and we will have to become a nation of generalists. Our lives will likely become more like our grandparents than our parents. That could be a very positive way to live. We will have less mobility. Some regions of the country will not be able to survive at their current density and will depopulate. If somehow this current economic calamity plays out better than expected, be grateful, but the paradigm is changing and there will be no going back to the old sprawling profligacy of the last 30 or 40 years. These are exciting times.

No comments:

Post a Comment